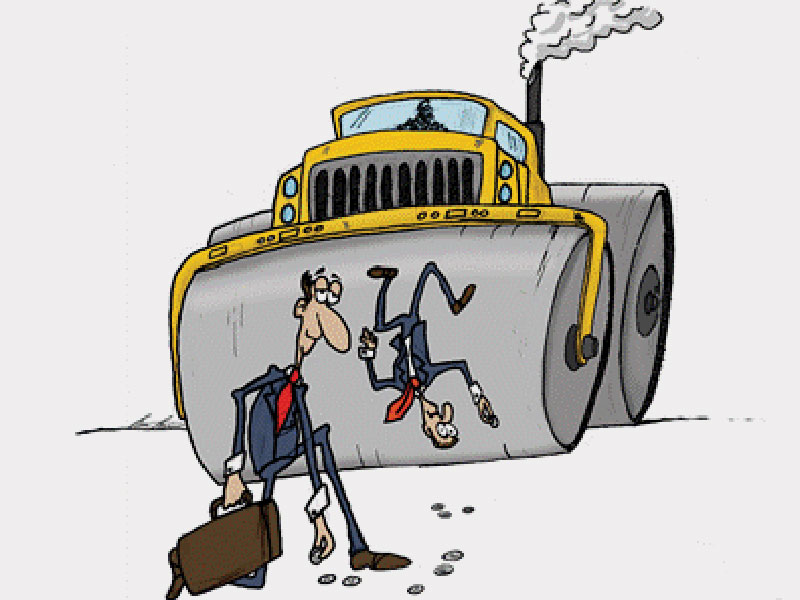

While listening to a recent research conference call, one of the analysts used the phrase, “Picking up dimes in front of a steam roller” as a metaphor for investing in the current environment. Some investors will indeed go out of their way to pick up small gains, while ignoring the possible risks they are taking.

We are not bearish, but we do believe caution is warranted when evaluating the current stock and bond markets.

In practice, there are countless examples of taking small profits with larger risks lurking. Dividend stocks and coupon bonds typically play a vital role for investors planning for retirement. However, like many things in life, there is no such thing as a free lunch when it comes to income plays.

Many of the highest-yielding dividend stocks are too good to be true. Their high yields simply reflect a higher risk profile and an unsustainable dividend that will be put on the chopping block in the future. For investors living off dividends in retirement, that’s a disaster just waiting to happen.

As a result, conservative income investors would do well to steer clear of most stocks with dividend yields well above 5%.

When evaluating risk, investors should always start by looking at the US Treasury market. This will give you a good idea of how the world is viewing risk at any given point in time. For example, as of this writing the 5 year US Treasury is yielding 2.99%. If you have investments which are paying significantly above that level, then you need to understand the risk of the investment. There are clearly opportunities globally which offer returns about this level, but we believe understanding the risk is prudent.

We continue to encourage clients to maintain a balanced portfolio which helps lower risk, it does not eliminate risk but it certainly helps.

Don’t hesitate to reach out with questions.